Fin VC Navigator – 1H 2020

Friends of Fin –

We are reaching out to share our 1H 2020 newsletter, which we distribute publicly with the broad global ecosystem to share our perspective and thought leadership, distill Venture Capital as an asset class, promote broader participation in FinTech, and support intellectual debate.

As you know, we take a long and patient view on our global relationships. As we serve as fiduciaries and add value for our entrepreneurs and partners, we recognize that growth can only come with merit. We thank our portfolio company CEOs, limited partners, co-investors, and Advisors, for your tremendous support.

In these ongoing newsletters, we provide our view and updates on three areas – 1) Global Macro; 2) Venture Industry & FinTech Sector; and 3) Firm and Portfolio Updates.

As always, we welcome your feedback and ideas and look forward to keeping a regular dialogue going with you all. We invite you to visit our website where we will continue to provide updates regarding firm activities, portfolio milestones, talent needs, and other news and events. Feel free to e-mail us anytime at [email protected].

Our 3 asks from you:

- Invest with or alongside of us. We welcome new long-term limited partners as well as co-investment collaborators who are aligned with our vision for driving transformation and innovation in FinTech through early stage business formation and acceleration.

- Introductions to exceptional Companies and Entrepreneurs. We love to meet CEOs early and often and we welcome your ideas and introductions to companies you are bullish on!

- Amazing Talent. We love meeting passionate and talented people and helping them find great teams and huge opportunities to work on. Please take a moment to review the Careers section on our website to learn more.

The Global Macro View

In January UBS began its 2020 outlook report with the observation that “amid a maturing demand cycle and heightened geopolitical risks, there is increasing potential for major events that could disrupt markets.” The report cited trade wars, climate change, tensions in the Middle East, US elections uncertainty, and ongoing economic troubles in the EU. At mid-year, these challenges remain, and have been joined by another: global pandemic.

Alphabet Games. According to Morgan Stanley’s (MS) mid-year 2020 forecast, this year will see 2020 global GDP contract by 3.8%, with growth returning to positive in 2021 with expectations of 6.1% for next year. This would represent the fastest annual growth since 1973. Within the US, MS expects a 2020 decline of -5.8% and a return to growth next year to 3.9%. The firm grounds its projections in the fact that the current environment is not the result of a typical recession or bubble, and also that the overall financial systems remain on solid footing. This forecast, which is essentially a V shaped recovery, in our view appears optimistic, but not out of the question.

Economists at UBS are forecasting base case W style recovery, with a slow, bumpy return to growth in the latter half of 2020 that gradually trends back toward normal growth. However, they also acknowledge that both a faster V or a slower U are also distinct possibilities. In our view, the question of recovery shape and timing is impossible to accurately gauge at this point. But focusing on whether it will be a V, U, or a W shaped recovery misses a more fundamental shift that is rapidly unfolding in the markets.

A Tale of Two Economies. In its report, UBS also noted that any recovery will not be evenly distributed across sectors, stating that “some industries may quickly bounce back to something very recognizable. Other industries − such as airlines, cruise lines, hotels, restaurants, sporting events, theater, concerts, and public transportation − may be impaired for a lot longer as we struggle to find a new balance.” We believe this divergence is significant.

There is continued strength in eCommerce, and recovering trends in real estate, homebuilding, and even auto sales. The financial sector has performed generally well, and FinTech has shown a great deal of breakout performance as the entire financial services industry moves aggressively online. In aggregate, the US markets appear heated with the current Schiller PE Ratio at ~30, near all-time highs on the S&P versus a declining earnings growth rate (-13.44%) and dollar weakness.

However, while the public markets have so far outperformed, in our view these gains are less a sign of strength and more a reflection of divergence and value migration. The reality is that the primary support has come from aggressive monetary policies and from a flight to technology stocks and in particular AAPL, AMZM, N, GOOGL, FB, MSFT. Look even deeper into non-tech sectors, and you will see that within sectors the most successful businesses are those who are best able to leverage technology and adapt.

In our view Covid-19 is less a change agent and more a dramatic accelerant. The winners and losers are not surprising, but the speed of the race is now measured in months not years. The issue is not how the economy is doing but rather how it is diverging. The rapid digital transformation that has led to a boom for tech companies; has allowed some tech-enabled legacy businesses to survive; and has severely hurt everyone else.

This division is even more pronounced in the private markets with technology adoption accelerating years of transition into months. While restaurants and SMBs on main street are struggling, scalable technology enabled companies like Instacart and the fintech infrastructure companies that support them are exploding.

As Dickens would say, “it is the best of times, it is the worst of times.”

Flatwater vs. Whitewater Conditions. At Fin VC this year has created some of the most attractive investment opportunities in FinTech in some time. We completed six transactions in H1, and currently have an investment pipeline that is larger and of higher quality than we have ever observed before. We wanted to take a moment to explore our strategic view in light of the ongoing market divergence in order to contextualize both the risks and opportunities.

During periods of extensive growth when commercial environments are stable the primary business strategy is to focus on scale, efficiency, and optimization of existing operating models and technologies. These are flatwater conditions, in which the precision and consistent stroke of the crew team deliver optimal performance. These cycles favor established businesses in mature/developed markets that are well capitalized and consistently managed. As a consequence, in extensive periods the large and established companies will often dominate the small and experimental.

During periods of intensive growth in which technology, political, and other macro conditions change rapidly and even chaotically, the primary strategy for success is to adapt quickly. These are whitewater conditions, in which the flexibility, agility, and durability of a kayak delivers not only performance but also ensures survival. These periods favor companies that can rapidly and accurately understand changing environments and realign business models, technologies, and operations to capitalize on emergent conditions. In intensive periods, the fast and nimble dominate the slow and rigid.

While the current macro environment is unprecedented, the chaotic conditions are not entirely unfamiliar to those who spend time working with early stage companies who are almost always in the rapids. As early stage Venture Investors we are aligned to invest into, navigate, and benefit from periods of accelerated transition and technology disruption. We focus on companies that have the potential to become scale players but are tactically nimble and capable of delivering rapid innovation. We monitor overall market conditions with a particular focus on cost of capital, valuations, consumer and corporate confidence, SMB support, and the overall regulatory environment for entrepreneurs, venture capital firms and the financial services industry. Understanding macro conditions alerts us to obstacles, but more importantly informs us of opportunities and catalysts to leverage.

Conclusions. While we all remain hopeful a vaccine will emerge by year-end, it is more realistic to assume mid-2021, creating a long-term period of uncertainty and coordinated global containment – with some countries and markets managing far better than others. We are closely watching China-HK-US relations, US Presidential and Congressional elections, distressed asset investment volume, ESG/SRI trends, and 5G infrastructure progress.

In our report at the beginning of the year we cited the risk of Covid-19 and noted that “any impact of the virus would be near-term rather than fundamental.” In principle this remains our view. What we have noticed in the last six months is that Covid has not changed the narrative, it has accelerated the pacing and increased the stakes.

We have seen six years of adoption and digital transformation compressed into six months. While this has created some clear laggards, it is also laying the groundwork for an enormous amount of value creation in the tech sector and in particular in FinTech over the coming 18 months.

Macro — What We’re Reading:

- Morgan Stanley Mid-Year Market Outlook

- UBS Mid-Year Market Outlook

- JPMorgan – David Kelly

- Goldman – GSAM Outlook

- Goldman’s global stock chief breaks down how the historically swift COVID-19 bear market stacks up against 140 years of history — and offers a look at what’s next

Venture Capital Industry Updates

Thanks to our friends at Pitchbook, SVB, and the NVCA for their “State of the Markets Report” report.

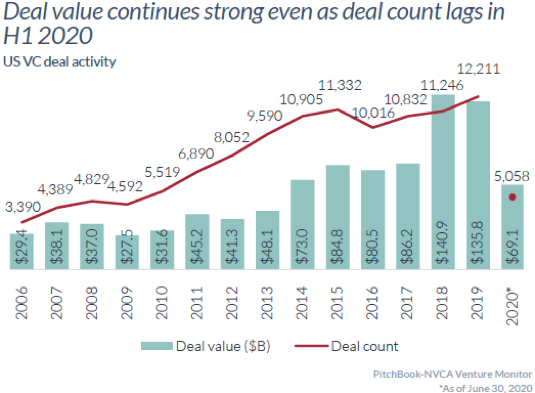

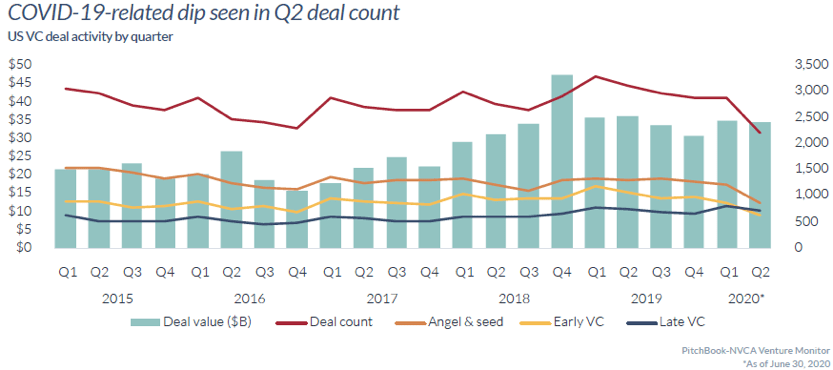

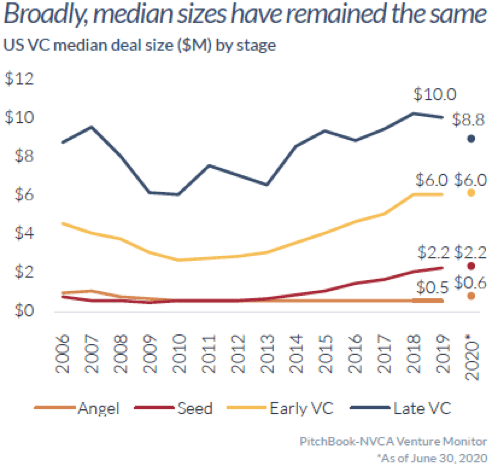

- Headline Summary: Venture firms largely became more conservative in March/early April, focusing on managing the “virtual pipeline management and diligence process,” conservative pacing on net new investments, portfolio stabilization and triaging existing companies, inside rounds to extend runway, and select opportunistic entry points. The portfolio companies were divided between those facing headwinds – raising bridge rounds, burn rate reduction/cost-cutting, and curtailing product roadmap/GTM plans (principally companies with B2C and B2SMB exposure) – and those that experienced the tailwinds of accelerated digitization and aggressively focused on growth and pipeline conversion (principally B2B SaaS and WFH catalyst plays – virtual productivity tools, food delivery, at-home fitness and streaming/gaming). As such, deal volume in 1H was 5,058 (vs. 12,211 total in 2019) and total invested of $69.1M (vs. $135.8M in 2019), driven principally by the strength of late stage financings (131 “mega-deals” of $100M+ representing $32M of the total) vs. first-time financings (1,194 deals, $4.6M invested) which fell to multi-year lows as a proportion of overall activity. Though deal volume is down, median round sizing Angel through to Late VC has remained flat, speaking to flight-to-quality on investment selection in a down cycle and larger fund/check size dynamics.

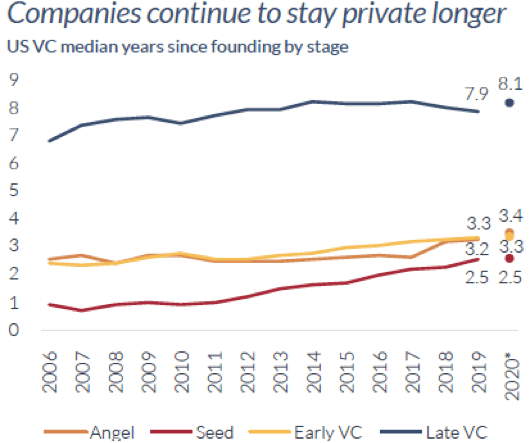

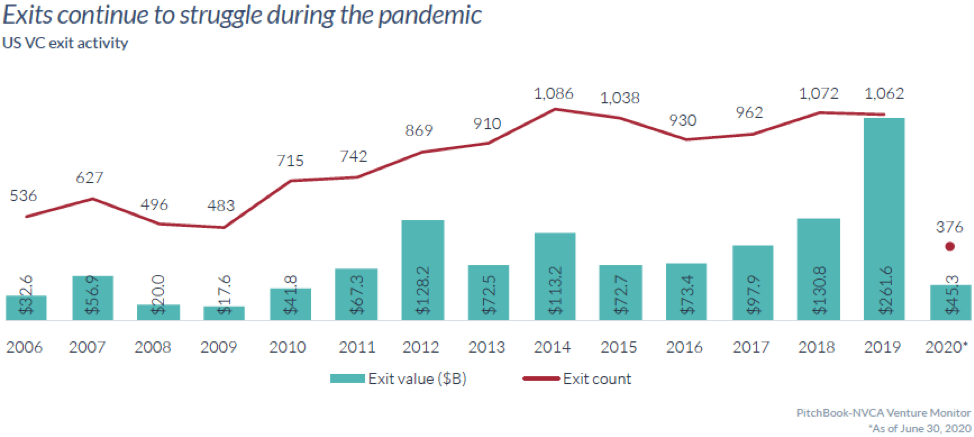

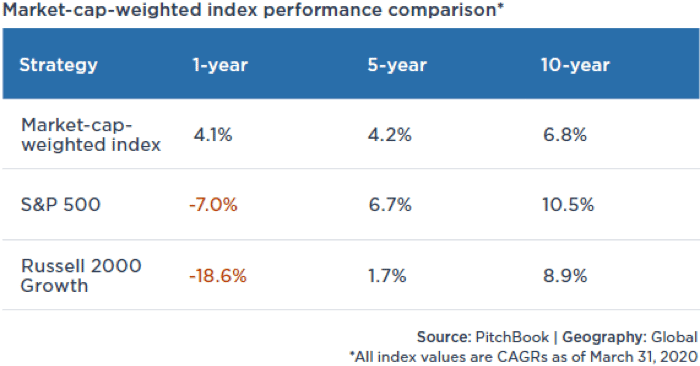

- Liquidity: Companies are continuing to stay private longer, as shown by the late stage VC average age of 8.1 years. Exit count in 2020 is tracking to be the lowest since 2011 and liquidity value is pacing to drop back toward pre-2017 levels, with Q2 seeing only 147 exits with a value of $21.2B, bringing the 1H total capital exited to $45.3B. The industry will need to closely manage liquidity prospects and drive positive cashflows in 2H to ensure that funds generate realizations (DPI/TVPI) for LPs or face problematic fundraising dynamics in ’21. IPO exits have been meaningful, Pitchbook has started tracking an Index of Venture-Backed IPOs (link to report) which in the 1 year benchmark is outperforming at 4.1% vs. the S&P (-7.0%) and Russell 2000 (-18.6%).

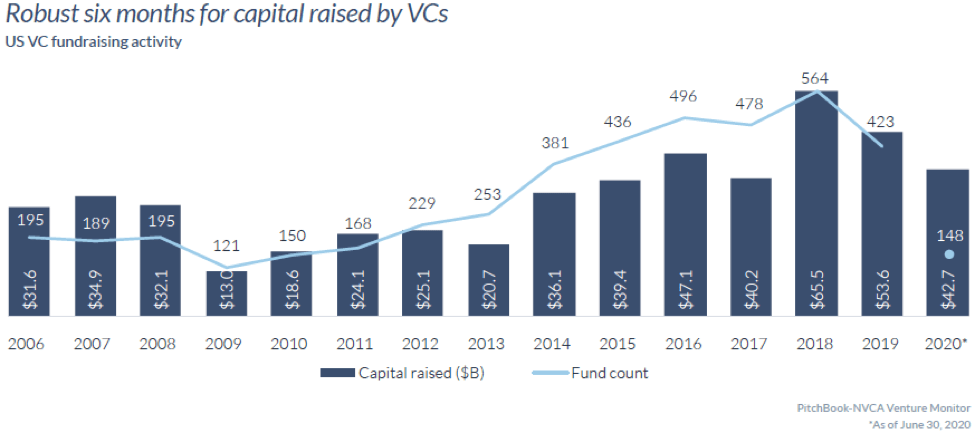

- LP Commitments: Despite external economic headwinds, fundraising data exhibited more strength in Q2 2020. Through Q2 2020, US VCs closed 148 funds totaling more than $42.7 billion, which already surpasses the full-year total for every year of the decade apart from 2016, 2018 and 2019. Following the recent trend, the capital raised was heavily concentrated in “mega-funds” ($500M+) who have closed $22.7B across 24 funds. This increase in outsized funds has driven the 2020 median fund size back over $100M for the first time since 2007. Though first time funds/emerging managers have outperformed established managers, they have observed a noticeable drop in access to capital with $1.5B raised across 14 funds in 1H – likely due to a lack of access to re-up capital, more conservative LP (flight to quality/top quartile) allocations, and the liquidity premium.

- The current VC industry story in pictures:

FinTech Sector Updates

Headline Summary: From a thesis and investment selection perspective, we have been broadly bearish for several years on the prospects for B2C and SMB-focused FinTech companies, with a strong bias toward B2B and principally SaaS businesses. That bias has proved prescient in the current macro, where we have seen an acceleration in the digitation adoption curve from incumbent FinServs, mature FinTechs, Insurers, Real Estate players, and Corporates. The Financial Services industry broadly spend ~$1T annually on technology (per Gartner), much of that on maintenance but a growing percentage, necessarily, focused on innovation and keeping up with the B2C/SMB-focused “disruptors.” We focus on those companies playing into this next wave of FinTech innovation and across our portfolio and network, we have seen their momentum surge in the current environment as the “nice-to-have” SaaS relationships have very quickly become “must haves.” That said, SoFi (also a portfolio company), Marcus, and other digital banks have reported strong pick-up in net new customer growth as consumers recognize the necessity to engage with digital-first/tech enabled companies and leave their “branch-first” legacy relationships behind. Unclear as yet how the digital banks will perform from a lending perspective, as credit boxes and spreads have tightened, volumes have come down, and consumer credit profiles have deteriorated in the wake of unemployment highs and macro pressure. SMB focused businesses (lenders, POS, etc.) have faced significant headwinds as these companies have come under macro pressure, seen record shut-downs, and rising competition from government monetary and fiscal relief programs.

Liquidity/M&A: As we highlight below/above, deal volume may be down but the M&A and consolidation theme has continued to escalate as legacy players (Networks – Visa and Mastercard and Cores – FIS and Fiserv) and mature FinTechs (Intuit, PayPal, and Square in particular) seek to own more of their respective value chains facing increased competition and gross margin compression. We believe the Banks will play an even more pivotal role in FinTech funding as regulators plan to ease the Volcker Rule, allowing banks to invest in Venture Capital funds (thank you!) and take a more active direct investing role in FinTechs. We foresee Morgan Stanley (who has already acquired Solium and E-Trade in an effort to access new distribution channels and bolster tech capabilities), Goldman Sachs (who via Marcus has rolled up Clarity Money, Bond Street, Final, Folio Financial, and taken enumerate minority positions out of its PI group), and JPMorgan (who needs to make a play after multiple Millennial-focused product failures developed internally) making aggressive moves to catch up in internal tech/operational efficiencies, risk management, frontier tech adoption (Blockchain, AI/ML, etc.) as well as consumer and commercial facing tech. Additionally, we expect Big Tech – Apple, Amazon, Facebook and Google – to continue making selective acquisitions in FinTech to drive x-sell opportunities and stickiness to their respective install bases. In the public markets, FinTech IPOs have shown significant strength with Lemonade (140%) and nCino (195%) popping and have outperformed the broader Financial Sector stocks which are down nearly 21% (as of July 24). We look forward to seeing the IPO performance for Policybazaar, Ant Financial, and Lufax, as well as the potential impact of SPACs (see OpenLending deal and we are excited for our friends at Ribbit) in the market.

M&A Volume: $95B+ – Largest Deal: Intuit acquired Credit Karma for $7.5B. Additionally, select deals include: Visa acquired Plaid ($4.9B), SoFi acquired Galileo ($1.2B), Square acquired European P2P payments startup Verse, Mastercard acquire API provider Finicity ($1B), Worldline SA acquired Ingenico Group SA ($8.51B), Empower acquired Personal Capital ($1B), SIX Group acquired a majority stake in BME ($2.9B), Open Lending merged with Nebula Acquisition Corp ($1.7B), Forge Global merged with SharesPost, WEX acquired eNett and Optal ($1.72B), and Credit Sesame acquired the Canadian challenger bank Stack. In the traditional FinServ/Insurance world, Aon acquired Willis Towers Watson ($36B) and Morgan Stanley acquired E*Trade ($13B). Lastly, we observed the first distressed sale of the cycle with one of the original FinTechs, OnDeck, being acquired by Enova ($90M) – we anticipate further consolidation or SPAC activity with Lending Club and GreenSky trading at fractions of book value. North America continues to outpace the EU in terms of M&A activity (61% vs. 27%).

Global 1H 2020 FinTech Data

— Our analysis/tracking and our friends at FT Partners (see Q2 Report)

- Financing Volume: $20.2B – Largest Financing: Stripe – $600M, with mean round size of $28M.

- # of Financing Deals: 898 – 711 with announced $ amounts; 187 without, including 47 mega rounds ($100M+)

- M&A Volume: $95B – Largest Deal: Intuit acquired Credit Karma for $7.5B. Additionally, select deals include: Visa acquired Plaid ($4.9B), SoFi acquired Galileo ($1.2B), Square acquired European P2P payments startup Verse, Mastercard acquire API provider Finicity ($1B), Worldline SA acquired Ingenico Group SA ($8.51B), Empower acquired Personal Capital ($1B), SIX Group acquired a majority stake in BME ($2.9B), Open Lending merged with Nebula Acquisition Corp ($1.7B), Forge Global merged with SharesPost, WEX acquired eNett and Optal ($1.72B), and Credit Sesame acquired the Canadian challenger bank Stack. In the traditional FinServ/Insurance world, Aon acquired Willis Towers Watson ($36B) and Morgan Stanley acquired E*Trade ($13B). North America continues to outpace the EU in terms of M&A activity (61% vs. 27%).

- # of M&A Deals: 409 – 68 with announced $ amounts; 341 without

- US FinTech IPOs (market cap): Lemonade ($4.35B), nCino ($6B), GoHealth ($6.1B), Dun & Bradstreet ($10.8B), Shift4Payments ($3.2B), Accolade ($1.5B), and SelectQuote ($2.2B).

What We’re Reading As VC’s and FinTech Nerds:

- Why 2020 Is The Year For Fintech

- 7 Ways Financial Institutions react to FinTech Co’s

- Why Covid-19 Has Been Great for SaaS VCs. Or at Least, Their Portfolios

- Fintech Acquisitions Show Sector Strength Despite Covid-19

- WealthTouch’s Burton Malkiel breaks down day-trading millennials

- A VC’s Guide to Investing in Black Founders

- Lemonade a guide for insurance IPOs? Probably not

- Crash Analytics: What the Last Two Downturns Tell Us About the Future of Early Stage Financing

- Google: The Next Big Fintech Vendor

- It’s Time To Build – Marc @ A16Z

- Ben Thompson @ Stratchery

Firm Updates

- Our Unique Vision for VC: We believe the future of Venture Capital is “multi-strat” with deep industry sector expertise and a synergistic set of fund offerings including our Flagship offering being principally US/EU focused, Specialty funds that represent sub-strategies of the Flagship where we see significant greenfields, and Regional funds that focus on a specific geography and establish teams with deep local expertise and networks. Indeed, we believe in specialization and a repeatable macro and thesis-driven approach to VC investing in which we proactively identify and source portfolio companies. Further, LPs desire less blind pool risk, a need to understand what they’re investing in and in parallel, entrepreneurs want clarity on investment criteria, strategic alignment, and differentiated value-add. Alongside of our fund strategies, we believe LPs increasingly wish to invest directly in sponsored opportunities and have set up a co-investment platform, alongside of our funds (direct to cap table, no fee layer) and in Opportunistic special situations (growth/late stage that don’t align to our early stage strategies but around which we have conviction and unique access).

- Team: We are pleased to welcome Christian Ostberg to our team as a Senior Associate, who is based in NYC and will head up our future office there. Christian joins us from Thomvest Ventures and was previously an entrepreneur at Eden, an investor at KKR, and a banker at Houlihan Lokey. Additionally, we have added May Wang to our SF team, who recently graduated from Columbia Business School and was previously an MBA Associate at several VC firms focused on FinTech/B2B and was at Goldman Sachs prior to b-school. Additionally, we have Sarah Silke on the team as a Summer Associate, she is completing her MBA at Darden and was previously at Cambridge Associates. We expect to add to our team in 2H at the Associate level (SF/NYC) and in MBA/Intern Associates (SF or Virtual) if you have referrals, we welcome your thoughts (finvc.co/careers)!

- Our Values: We developed 3 core values as a firm at inception and wished to share those publicly. Additionally, we have developed a unique organizational model for our team that outlines these values, our cultural norms, along with clarity on role metrics and goals and transparency into firm role compensation. Our 3 core values include:

- ONE Firm: We operate as a single global team focused on the same success metrics. Regardless of your role, focus area, or fund affiliation, we serve 3 constituencies at all times – LPs, Portfolio Companies, and the Firm, in that order.

- Integrity: Doing the right thing at all times even when no one is looking. Voice your views, be honest/transparent, value diverse opinions, and ask for help when you are uncertain.

- Meritocracy + Culture: Metrics and tangible actions matter most, but so too does culture, we value diversity as we believe diverse teams drive better decision making and we have a strict no jerks policy.

- Diversity Initiatives: As we share above, one of our core values and deeply held beliefs as a firm is that diverse teams drive superior outcomes. We agree that VCs have done too little in terms of their own teams and in the portfolio companies they invest in to support diversity initiatives and looking beyond the typical talent pipelines. Our portfolio currently has strong diversity amongst founding teams in terms of female CEOs, LGBTQ leadership, and diverse board and management team members. In addition to our own commitment to diversify our firm and continue to strongly consider diverse founder teams, we have donated and become a partner firm to HBCU VC and Valence, both terrific organizations making a huge impact on the gaps that remain in racial and broader equality. Actionably, per above, we have set up a Careers section of our website, where we are receiving incredibly diverse applications, and plan to leverage our Associate Intern program as a basis for training and subsequently recruiting full time diverse talent to our firm and across our portfolio, whom we will survey/measure quarterly on this basis as well. We are also committed to hiring diverse talent at the Investment and Venture Partner levels at our firm. We encourage our peers and the industry at large to take action and drive meaningful metrics and change.

- Integrating SRI Screens into Investment Process: Given our values and view that ESG/SRI will continue to become a driver in differentiating portfolio companies and driving lasting social, governmental, and corporate change, we took a natural step of incorporating these principles into our investment process. We are pleased to share that we have been formally accepted and approved as an Investment Manager by the Principles for Responsible Investment (PRI) organization as a signatory and will be incorporating the six UN principles into our investment process. Hence, our current and subsequent funds will comply with ESG/SRI mandates where we have seen significant portfolio company and LP support.

- New Office Space: We have moved into our new offices, after postponing due to Covid, in Jackson Square in downtown San Francisco (473 Jackson St. Fl 3). Our team is using a combination of WFH and rotating office use while practicing social distancing and mask wearing/other protective measures, along with regular testing. We welcome our portfolio companies and the FinTech community to join us in the future and look forward to hosting regular events when we all return to some degree of normalcy.

Portfolio Company Updates

Sharing the latest and greatest from our Portfolio Companies, if you would like to connect with the company and respond to the “Call to Action” please e-mail us at [email protected] and we will facilitate a warm introduction!

Flagship Fund I

Aiera is an adaptive deep learning platform designed to aggregate all publicly available market data, provide quantitative analytics using AI/ML for fundamental investment strategies, and provide real time earnings call/events transcription and summaries. Aiera supports asset managers, hedge funds, private banks, and corporate CFOs/IR functions.

Call to Action: An equity analyst, PM, or Corporate CFO/IR lead and still listening to earnings calls and events live, seriously? Trial Aiera and let them transcribe and synthesize with AI for you.

Recent Press:

Avinew is serving as the middleware platform between OEMs producing semi-autonomous and autonomous assets (cars, trucks, drones, robotics) and insurance providers who need the data/capabilities to underwrite these news risks and technologies.

Call to Action: Insurer still not sure how to underwrite new technologies or an innovative OEM needing fleet-level or consumer/commercial insurance coverage? Reach out to the Avinew team to collaborate!

Recent Press:

Axio’s mission is to solve the Cybersecurity problem for corporates and insurers being the source of truth in quantifying and managing cyber risk and provide inputs to underwrite ongoing insurance coverage. Axio’s software enables organizations to manage their risk registry and cyber frameworks to identify/mitigate gaps, define existing insurance coverage (through policy assessment automation – AI/ML and NLP), report in risk and financial terms to both CSOs and board-level users, and provide the exact inputs insurers need to continuously underwrite cyber risk.

Call to Action: Still maintain your Risk Registry in Excel and have no idea what your Cyber Insurance policy says? Reach out to the Axio team asap!

Recent Press:

- Fin VC – Why We Invested

- Axio Announces Partnership with Archer to Provide Real-Time Visibility into Cyber Risk Management for Critical Infrastructure

- Axio Named a 2020 Gartner Cool Vendor in Integrated Risk Management

- Axio Welcomes Jason Adair as Chief Sales Officer

- Axio : Joins the Cyber Readiness Institute Champion Network to Help Organizations Assess Cyber Risk

BrainTrust is “building a fair future for work” connecting global companies and knowledge workers on a dynamic talent platform powered by Blockchain/DLT. The platform supports employers in sourcing top tech freelancer talent, who have a central place to aggregate work history/reputation, create transparency and tracking in projects, manage teams, and receive tokenized payments. The token (BTRUST) is the sole ownership unit and provides incentive alignment and network effects for referrals, while increasing value from Gross Service Volume (GSV) from employers.

Call to Action: Corporate or mature tech company looking for leading tech talent? Freelancer looking for a fairer platform to drive pipeline? BrainTrust, period.

Recent Press:

Coinsuper aligns to our Blockchain Enterprise Applications thesis, in providing an expansive set of services to the growing crypto-asset industry in Asia, with a focus on institutional investors. The company is based in Hong Kong and has a strong management and technical team, with deep financial services industry, FinTech, and blockchain/crypto experience. Further, the vision for the company aligns to our view on the role of exchanges and platforms in the space, in providing a diversified set of services primarily to institutional customers via multiple channels (Exchange, OTC, Brokerages, and Custodians).

Call to Action: Looking for a licensed exchange, custodian, or token listing platform partner in Hong Kong or Singapore? Very few options outside of Coinsuper.

Recent Press:

CRE Simple provides an integrated SaaS platform for Commercial Real Estate market participants, providing investment/deal management, access to credit/equity bids, an automated quote engine, intelligent task prioritization, collaborative workflows, and predictive outcomes.

Call to Action: CRE broker, lender, or asset manager looking for a comprehensive platform to manage all aspects of your funnel? Check out OneSource.

Recent Press:

Figure has built a financial services business (Figure.com) that sits on top of a blockchain platform (Provenance.io) that enables digital lending, asset management, and an ecosystem of services to lenders, banks, credit investors, and secondary players.

Call to Action: Figure caters to consumers looking for a tech-enabled process to get a HELOC, Mortgage/ReFi, or Student Loan ReFi. Additionally, its blockchain platform helps originators, credit take-out partners, funds needing tech-enabled admin, and companies looking for improved equity, cap table, and secondary liquidity.

Recent Press:

Funnel Leasing is the leading leasing and marketing platform for multi-family, enabling owners and managers to generate more profits, efficiency, and analytical insights across their portfolio. The team has built strong traction with real estate property managers, landlords, and brokers, driving strong stickiness with a growing customer base.

Call to Action: Property manager looking for a modern solution to managing your multi-family portfolio? Optimize your Funnel.

Recent Press:

Netomi has built an advanced AI/ML deep learning platform to address the challenges of customer service across all industries, but with massive implications for Financial Services. Companies spend ~$400B/yr on customer services agents alone with over 1B tickets being generated a day via phone, e-mail, and live chat. The team is tackling this problem with a platform that provides enterprise customers a seamless way to automate customer service interactions across e-mail, chat, and social.

Call to Action: Still using call centers? Customer Success team overwhelmed? Leverage Funnel for omni-channel customer service automation, powered by deep AI/ML/NLP capabilities.

Recent Posts:

Numbrs has built the future of asset management and digital banking. Building its platform out of Switzerland, the team has scaled principally via a B2B2C model to offer full stack financial services through bank, asset management and insurance partners across the EU. The product utilizes deep AI/ML, data aggregation, behavioral analysis, and open APIs.

Call to Action: Numbrs has become the EU/UK’s dominant B2B tech partner, providing banks, insurers, and asset managers with superior mobile and web tech.

Recent Press:

Pipe is transforming the fundamental economics of the global SaaS market. The company provides instant cash advances to recurring revenue companies, enabling them to unlock their deferred cash flows through non-dilutive funding. Pipe’s advanced API financing platform automates the entire financing process for SaaS companies and delivers account level visibility and instant liquidity without the need to take on any debt or dilution.

Call to Action: Pipe turns MRR into ARR for SaaS companies. Still discounting yearly fees? Don’t. Use Pipe’s streamlined process and ecosystem instead. Huge opportunity for the asset management and credit community to access a unique asset class.

Recent Press:

SoFi is one of the leading consumer US FinTechs with full stack product offerings across lending (student loans, personal loans, mortgages), banking (checking, savings, and credit), wealth management, digital assets, and insurance, principally catering to Gen Z and Millennials.

Call to Action: Still using a bank that has branches? Millennial or Gen-Zer whose bank doesn’t understand you? Get your Money right – SoFi.

Recent Press:

- SoFi Files for Its First Bond ETF

- SoFi just filed an application for a national banking charter, and CEO Anthony Noto told employees it’s a critical strategic step for the $4.3 billion fintech

- SoFi Invest (And Commission-Free Trading) Comes to Hong Kong

- SoFi Acquires Payment Processor Galileo in $1.2 Billion Deal

Co-Investment Platform

DailyPay is modernizing payroll through FinTech, providing a thin layer between legacy payroll, time management systems, and HR systems to enable employers to deliver financial services to their employees, with short term lending being the starting point to a more comprehensive product roadmap. DailyPay is generating a double bottom line impact by combating the punitive pay-day lending business and offering hourly workers, freelancers, and independent workers an alternative to taking advances on future earnings – reducing financial stress, turnover and costs to both employees/employers.

Call to Action: If your Payroll administration and HRIS look like they were built in the 80’s and you employ hourly workers, DailyPay is going to be your optimal solution.

Recent Press:

Onfido is the leader in digital ID, providing 3 layers of verification – government issued ID, biometric scan, and voice patterning/recognition. Companies like Square, Revolut, BBVA, Uber, Google, and Avis use the Onfido API to mitigate fraud/regulatory risk, manage hiring diligence, expedite KYC/AML requirements, and conduct ongoing cybersecurity checks on customer and employee access.

Call to Action: Banks, FinTech, Health Care providers, Sharing Economy companies, Insurers, and anyone with the need to manage customer and employee digital identity are using Onfido – the dominant player in ensuring ID verification globally.

Recent Press:

Tradeshift is the world’s largest, open, digital commerce platform, providing SaaS supply chain solutions and enabling enterprises to connect, transact and collaborate with all of their business partners – including payments, lending, and marketplace activities.

Call to Action: Global corporations with complex supply chains, a myriad of legacy systems, x-border payments and lending needs are partnering with Tradeshift as a single platform and ecosystem to solve all of their trade challenges.

Recent Press:

Fin VC in the News

- Check out our News Feed, LinkedIn and Twitter

- Logan Allin – Best in SaaS Interview

- Logan Allin & Peter Ackerson – Future1 Interview

- Logan Allin – Valence Advisory Interview

- Logan Allin – Virtual Keynote with Family Wealth Report

Stay safe, healthy and optimistic in this surreal environment,

Fin VC Team